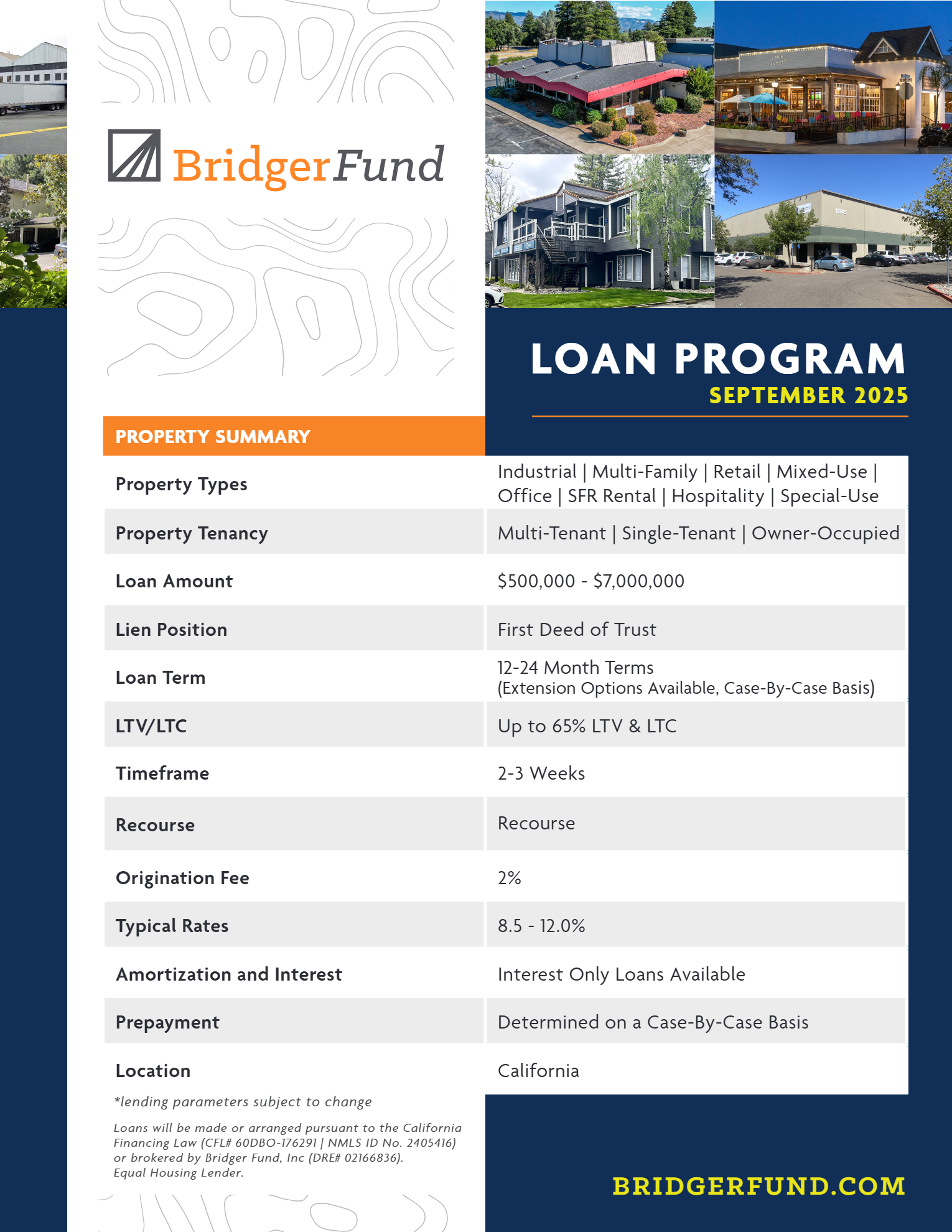

Loan Program

Bridger Fund Loan Types

1. Bridge Loans

- Short-term financing for acquisitions, refinances, or recapitalizations

- Ideal for time-sensitive deals or transitional assets

- Terms: 6–24 months

2. Acquisition Loans

- For purchasing commercial properties quickly

- Often used when conventional financing is too slow or unavailable

3. Refinance Loans

- Used to pay off existing debt or recapitalize equity

- Helpful for borrowers seeking better terms or more flexibility

4. Owner-User Loans

- Tailored for business owners acquiring or refinancing their own commercial space

- Flexible underwriting for non-institutional borrowers

5. Value-Add & Rehab Loans

- For properties undergoing repositioning, lease-up, or light renovation

- Funds can be structured to include improvement budgets

6. Cash-Out Refinance Loans

- Allows borrowers to extract equity from stabilized or appreciating assets

- Useful for reinvestment or liquidity needs

7. Bridge to Life Insurance Company Permanent Takeout

- For properties looking for a refinance once stabilized, we can work with Slatt Capital to prequalify a property for a permanent life insurance company loan on stabilization

- Our borrowers have taken advantage of this program with multiple different life insurance company correspondents of Slatt Capital